The global economic market is highly volatile. Thus, to maximize the capital trading gain, forex trading is the best measure. The United Kingdom is the best nation to begin the forex trading journey. This is because the British Pound (£) is one of the highest-valued currencies. According to reports, £1= $1.25 is the conversion rate in the latest times.

In the UK, The Financial Conduct Authority (FCA) is a regulatory body to regulate forex trading in the UK. However this trading method is not everyone’s cup of tea and therefore giving the brokerage to the best forex brokers in the UK is the right option to bet on. They have access to advanced algorithms, multiple forex pairs, and others.

As 2025 approaches, we are aware that you might be aiming for higher profits in forex trading. There is no need for you to fret searching for the best forex brokers in the UK. Maximize your profits in forex trading by becoming the clientele of these best forex brokers in the UK.

How to Find the Top Forex Brokers in the UK?

Always remember that your personal finance is at risk while forex trading. Hence, pick the right forex broker in the UK that has a unique trading style, FCA licence, offers a diversified portfolio, minimal brokerage and easy payment methods.

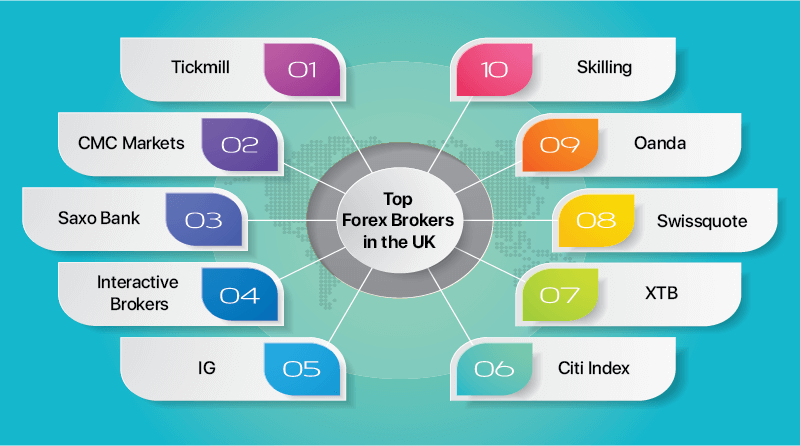

Top Forex Brokers in the UK for 2025

Before exploring the names, we would like to inform you that all top forex brokers in the UK are compliant with FCA licenses. Hence, your capital is in safe hands.

1. Tickmill

Tickmill is the first name in our list of forex brokers in the UK. They charge a low commission and operation fees. Therefore, this forex broker has earned trust and credibility across British territory. One major feature is that they use MetaTrader 4, MetaTrader 5, MetaTrader WebTrader Platform, MetaTrader for Mac and Tickmill Mobile App trading platforms.

They give traders access to more than 60 currency pairs. Professional traders who want to trade in high volumes may prefer this platform. The welcome bonus on creating an account is $30.

The deposit/withdrawal gateways are Visa card, Master card, Net banking, cryptos, Neteller, STICPAY, WebMoney and UnionPay. Customer support is available 24×7, and the required minimum deposit is £100 on Tickmill.

2. CMC Markets

CMC Markets is a trustworthy name in the brokerage giving access to over 10000 trading instruments. It was founded in 1989, and now it is being regulated under five Tier-I and two Tier-II FCA regulations. Its market share is significant and there are different discounts available on CMS Markets for traders’ ease.

A mobile app with a user-friendly interface makes it more popular and a favourite forex broker. There is no dealer intervention and the broker commits to a 99.97% fill rate with minimal slippage. Moreover, they combine eight tier-one bank feeds to deliver the accurate price. Traders have the privilege to trade on 12 forex pairs basket including the CMC USD index.

3. Saxo Bank

Saxo Bank is an investment banking company also involved in the forex brokerage services in the UK. They have diversified investment products for investors like stocks, bonds, mutual funds, and others. Besides, in forex trading, traders get access to 185+ pairs.

They have a 1,00,000+ customer base with award-winning support and more than 30 years of experience. Saxo Bank’s Tier-1 liquidity gives higher fill rates, fewer premature stop-outs and prominent improvements. Cash rebates, FX pair trades and less premature stop-outs are additional features that make forex trading easier and more profitable.

4. Interactive Brokers

Since 1977, Interactive Brokers has been in existence. They are regulated under nine Tier-1 jurisdictions. One major factor that we found is the market valuation of this forex broker in the UK is $373.9 billion. Traders have access to 33 countries and 23 currencies. A vast variety of advanced trading tools Trader Workstation (TWS) is provided by this broker.

There are no hidden spreads or markups. Besides, there are low commission costs charged by Interactive Brokers with a 0.08 to 0.20 bps times trade size. All these benefits make no room for conflict of interest with traders. A review platform Forexbrokers.com has rated them 5/5 for operational efficiency and professional forex trading.

5. IG

IG is committed to delivering the best trading performance with no hassles. With them, traders have access to trade spread bets, and CFDs (Contract for Differences) over 17,000+ markets. Advanced suite of risk and management tools with platforms like L2 dealer, ProRealTime and MT4. There is a mobile app that provides valuable trading insights, recommendations and technical support to traders.

Add-on features are live news updates and live market prices of currencies. These features help traders bid on currencies in real-time. Creating a live account and a demo account is easier with IG which no other forex broker in the UK provides. They were founded in 1974 and currently have a client base of more than 3,13,000.

6. Citi Index

City Index has 40 years of experience and shares the success stories of 1 million+ clients. Traders get access to competitive markets with 84+ currency pairs including majors, minors and exotics. Get excellent market conditions for trading with Tier 1 bank’s liquidity. They claim a success trade rate of 99.99%.

The average execution speed is less (0.02 sec) and features like the economic calendar and live feeds make the Citi Index more user-friendly. From just 0.7 points traders can start trading on it for currency pairs including EUR/USD. They are a part of the Sonex group which is listed on the US stock market.

7. XTB

XTB helps traders to navigate through different foreign markets and currency pairs. Moreover, they have 5500+ forex trading instruments with an extensive learning resource. For 18+ years they have successfully built a trademark of excellence and commitment among the forex trading community. Live chat support is available between Monday to Friday only.

The best part about it is that no minimum deposit is required to start forex trading. Brokerages are also cheaper and their algorithms try to bring maximum profit for traders.

8. Swissquote

In the early 90’s, Swissquote stepped into the forex trading industry to become one of the prominent forex brokers in the UK. There is a versatile marketplace for forex trading in the UK. There will be good financial stability while choosing this forex broker because it operates three banks as well. Get insights in the latest market feeds from or written news articles.

As a trader, you will get daily market analysis and add-ons like MetaTrader Master Edition. For a better user experience the platform of TradingView charts are compliant with HTML5 for the maximum accessibility of the trading platform.

9. Oanda

US-based, Oanda is gaining popularity as a forex broker in the UK by offering a wide range of assets to trade. Competitive trading and tradable assets are some features that give them an award-winning brand power. With them, forex traders in the UK get access to 70+ currency pairs with 0.8 pips.

Oanda does not charge minimum deposit fees and traders get a bonus of free monthly withdrawals. They leverage multiple software and trading tools which include MetaTrader 4, TradingView, and an independent web platform. The TradingView platform gives traders the freedom to create custom technical studies which are unavailable in MetaTrader.

In UK, there is no tax charged on spread betting which is provided by this forex broker while trading. Many brokers lack in providing the spread betting feature.

10. Skilling

Raise your forex trading skills with Skilling in cryptos, currency pairs and much more. They have 4.3/5 star ratings on Trustpilot. Traders have a choice to trade between a standard spread-only account and a premium account with minimum spreads and volume-based commissions. Top features like the cTrader platform, copy trading and less spread commissions account are available for traders in it.

The minimum deposit will be £100 with the faster order execution. cTrader is their in-house-built trader platform with user-friendly features.

Is Forex Trading Legal in The UK?

Yes, the UK does not prohibit forex trading activity. However, the brokers in the UK must have an FCA licence. This licence gives authorization to brokers to offer trading services to clients.

FCA also provides compensation rights to retail customers in the event of insolvency or bankruptcy. Financial Services Compensation Scheme (FSCS) provides up to 85,000 GBP of protection to eligible individuals.

It’s important to note that in the UK traders who have been designated professionals do not receive such protections. In order to avoid being scammed, you must ensure that your forex broker is FCA-regulated.

Will Forex VPS Hosting Server Help Brokers in the UK?

Yes, Forex VPS hosting servers can be very helpful for brokers in the UK in several ways:

- Improved execution speed and reliability: A Forex VPS server provides a dedicated, low-latency connection to the major forex trading platforms, which can significantly reduce execution times and minimize slippage. This is especially important for brokers who cater to high-frequency traders or those who rely on automated trading strategies.

- Increased uptime and availability: VPS servers are hosted in secure data centers with redundant power and backups, ensuring near-constant uptime and availability for your trading platform. This is crucial for brokers who need to maintain their clients’ trust and avoid any potential disruptions during critical trading hours.

- Enhanced security and compliance: VPS servers offer advanced security features like firewalls, intrusion detection systems, and data encryption, which can help brokers comply with industry regulations and protect their clients’ sensitive data.

- Scalability and flexibility: VPS servers can be easily scaled up or down to meet changing demand, allowing brokers to adapt to their clients’ trading activity and avoid overspending on resources. Additionally, VPS servers offer flexibility in terms of software compatibility and customization, allowing brokers to tailor the environment to their specific needs.

Conclusion: Which Is the Best Forex Broker in the UK?

Table toppers or brokers with the least commissions, which one is the right trading partner for you? The answer depends on capital risk, type of trading software, MT4, MT5 requirements and spread account features. Check whether you can trade in volumes of currency pairs or not.

Substantial market reach and trading convenience cannot be ignored. But one major point to consider is the FCA-compliant brokers in the UK. Always prefer the licence holders that will keep the capital safe and secure.