Online transactions or digital payments globally have a market value of $7.79 trillion in 2023 which is growing by a CAGR of 11.83% annually. Out of the total market share, the UK holds a significant portion of $445.10 billion in 2023. Thanks to the growing eCommerce sector and digital payment gateways in the UK that allow online transactions hassle-free.

A payment gateway ensures fast, secure and easy transactions without cash. Mostly, eCommerce stores integrate payment gateways in their system which allows a hassle-free transaction. They accept popular online payment methods. If you are setting up an eCommerce store in British territory, eCommerce hosting and payment gateways in the UK are also essential. There are different online payment providers in the UK offering the best payment gateways.

What is Meant by Payment Gateway?

A payment gateway is an online interface that authenticates customers’ payment information, collects them and completes the transaction process.

When customers enter their card information and payment details to purchase products, the gateway authenticates data and proceeds further. This online payment gateway is opened in a separate window to enter transaction details. After that, OTP is sent to the registered mobile number which the customer is supposed to enter. Both parties (customers and merchants) in the payment are involved in the financial exchange. If there is a technical halt, funds stay with customers.

Thus, online businesses rely on the best payment gateways to complete the transaction process and ensure a safe monetary transaction. Online payment gateways accept debit cards, credit cards, e-wallets, and netbanking methods.

The major USP of online payment gateways is all payment details are encrypted that keeps the cyber criminals away.

How to choose a Payment Gateway Provider?

Choosing a payment gateway must be a smart process. Always go for a secured and trusted online payment gateway provider to maximise the business revenue. Most of you have heard about Razorpay and PayPal but many other providers are also in the race. Ideally, choose the provider that supports multiple transaction methods and volumes of capital.

Before choosing the payment gateway provider, merchants need to set up an account. Besides, credit card processing and card reader are offered by some vendors. Merchants need to install before choosing the right payment gateway provider. However, don’t ignore the gateway fees that a service provider is charging to merchants.

Most of the prominent payment gateways in the UK adhere to PCI DSS standards. It is a set of security regulations compulsory for every kind of business processing card transactions. With this, merchants and buyers both are ensured of a safe and secure transaction.

Every transaction made through the gateway is levied with transaction fees. Check the gateway provider charging less fees and security features. Below we have reviewed different payment gateway platforms in the UK.

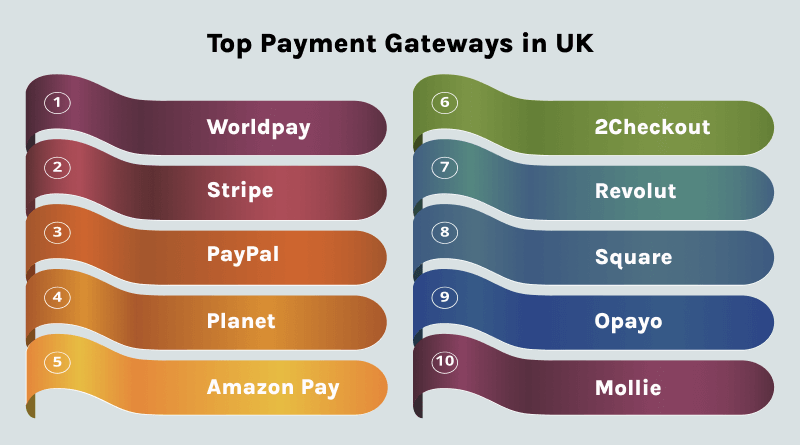

Top Payment Gateways in the UK: A Perfect Guide

1. Worldpay

Worldpay was founded by Worldpay Group in 1997. However, in 2019 FIS acquired the group for $43 billion Since then, the platform has emerged as the best payment gateway in the UK. Many small businesses in the United Kingdom are using it.

Benefits such as a fast transaction processing system, POS systems, EMV terminals, and mobile wallets are available in this payment gateway. Another funding feature FastAccess is available for gaming operators and players. This funding feature delivers funds in players’ and operators’ cards within 30 minutes or less. As a result, their gaming session doesn’t interrupt.

Extensive security and gift cards are favourites among the merchant and customer community. One thing we would like to highlight about Worldpay is the requirement for software expertise for integration. It is a complicated process and therefore it is built into the website’s backend as an API (Application Programming Interface).

Overall, it is one of the highly-rated payment gateways in the UK with a transaction count of 20 billion annually in 150 countries and 130 currencies. Also, it has processed over 40 billion transactions and $1.7 trillion in payment volume in 2022.

Pros

- Subscription payments can be set up easily

- Worldpay’s Risk Management Mechanism (RMM) provides ultra-secure payments

- Using the live dashboard view, you can monitor orders in real time

Cons

- There is a 2.75% + 20p transaction fee for the pay-as-you-go option

- Challenging for non-tech savvy users. Mostly, software developers can access it easily.

2. Stripe

Stripe is the next popular payment gateway in the UK with some advancements. They work on the best user experience and a streamlined checkout flow with limited sales friction. Customers or merchants using it get a range of payment methods accepted in global currencies.

This payment gateway accepts Credit and debit cards, bank transfers, direct debits, Click to Pay, digital wallets (Alipay, Apple Pay, Google Pay, WeChat Pay), Clearpay, and Klarna. More than 135 currencies are on this payment gateway platform.

Stripe Checkout is the hosted payment gateway offered by Stripe. Stripe’s modular UI Stripe Elements is easy to integrate into the website’s backend. Its API gives more control to merchants in customizing the payment gateway.

Pros

- Various integration options to suit different coding skills

- Pricing transparency

- A great user experience for desktop and mobile payments

- Brand name you can trust

Cons

- Fees are expensive

- Frozen accounts have been reported

- Customer service complaints

- Using Stripe effectively requires coding skills

3. PayPal

PayPal is a well-renowned payment gateway worldwide founded in 1998. It is used in more than 200 nations. As of Q3 of 2023, the total PayPal users’ stats are 431 million. According to the official report by PayPal, the active shoppers count in the UK is 20 million.

Not just small businesses, but established enterprises also use this payment gateway for financial transactions. Apart from payment acceptance, PayPal gives value-added services to merchants like shipping labels, capital to finance businesses and risk management.

PayPal for Business is a payment service dedicated to businesses only. The platform supports multiple international and national debit/credit cards. Many e-commerce, web hosting companies and other enterprises use this payment gateway in the UK.

PayPal has more than 20 Awards for Excellence which makes them a credible payment gateway. It helped many organized vendors that boosted the British economy.

Pros

- PayPal accounts can be used directly for payments

- Provide international payment acceptance

- Support for recurring payments

Cons

- Merchants with low volumes are charged high fees

- Only the expensive version allows for customization

4. Planet

The planet is a payment gateway that many small businesses in the British territory. It bridges the business-critical software and payment systems for top hospitality and retail industries. E-commerce checkout, or hotel bookings, Planet provides a streamlined payment system for worldwide users. Mostly, big hotel chains and retail businesses use it for global reach.

In this digital era, this fast-paced payment gateway platform has processed over €55bn transaction value with a registered merchants count of 8,00,000+. There are 100+ partner banks partnered with Planet. Different value-added products like VAT (Value Added Tax) Refunds, currency conversion, and marketing consulting streamline the business operations without any hassles.

As per their claim, currently, there are no transaction fees charged on the website. However, for a better understanding, contact the sales page.

Pros

- Globally available and a reliable payment gateway.

- Supports smart features like dynamic currency conversion, one-click payments, and payment buttons for Apple Pay, Google Pay, PayPal, and other digital wallets.

Cons

- No public information on fees is available on the website.

5. Amazon Pay

Amazon is also one of the payment gateway providers in the UK offering Amazon Pay platform. It captures a significant market share in British territory. It is a quick and easier payment gateway that scores 35% more conversion rates than the native merchant checkouts. Amazon Pay is compatible with top e-commerce platforms like Shopify, PrestaShop, BigCommerce and WooCommerce.

Amazon Pay was introduced in 2007 by Amazon Inc. Merchants or shoppers have to create an account to access this payment gateway. The account creation process is simple, they just have to provide an email address, name and password.

An integrated wallet feature “Amazon Pay Balance” is available where shoppers can add funds it and redeem the amount for shopping anytime. 80% of English citizens are aware of this payment platform in the UK. Like every payment platform, it also supports Visa and Mastercard, netbanking and UPI (United Payment Interface developed by India).

Pros

- Easy checkout Customers with Amazon accounts can easily check out.

- Widely accepted Amazon Pay is accepted on many websites.

- No setup or monthly fees Users only pay per transaction.

- Alexa voice integration Customers can use Alexa to place and track orders.

Cons

- Reserve policy Payouts can be delayed, especially for new accounts.

- No in-person payment support Amazon Pay doesn’t support in-person payments.

6. 2Checkout

2Checkout is a secured payment gateway in the UK that gives the best checkout experience for online consumers & merchants. Both buyers and sellers prefer this system for a simplified transaction process.

Merchants can accept payments in credit cards, bank transfers or cryptocurrencies. Most of the payment gateway platforms in the UK do not accept cryptos but 2Checkout does it.

2Checkout has had a presence for over two decades and is active in 170+ countries. Features like recurring bills and tokenized transactions. Anyone who wants to complete the payment process must have to redirected to the official site of 2Checkout.

Pros

- Globally processing credit card transactions.

- Provides Visa, MasterCard, American Express, Discover, PayPal, and Apple Pay as payment methods.

Cons

- Comparatively, fees are high.

- Unavailability of customer service.

7. Revolut

Revolut is a favourite payment gateway for eCommerce companies in the UK built on Shopify, Magento and WooCommerce. This payment gateway has different products/ services like multi-account payment systems, and Revolut Reader (A card reader accepting various debit and credit cards).

Besides, Revolut offers currency exchange and forward currency contracts for foreign merchants. This payment gateway accepts global payments. With the fast in-person payments this payment platform has earned the 4.8 ratings by experts.

Daily financing and account opening facilities are available which makes Revolut a small size bank also. Its online transaction is 1% + 20p which makes it the cheapest payment gateway in the UK. However, features are limited in comparison with Worldpay.

Pros

- Cheapest transaction fees charges.

- In-built invoice tool.

Cons

- Limited analytical reports feature.

- Less fraud detection systems.

8. Square

Square is one of the best payment gateway in the UK suitable for mobile payments. Therefore, it is trusted by 4 million+ customers in the United Kingdom and worldwide. As per Q1 2023, the total count of processed transactions was $4 billion+ (2022-2023).

Square is perfect for delivering a customized user experience. It is easy to integrate with your business software or website using Square APIs for payments, commerce, customers, staff, and merchants. Moreover, merchants can connect Square payment hardware to their business software using Terminal API, Reader SDK, and POS API.

Apart from this, the mobile app “Square App Marketplace” was introduced a few years ago for mobile users. Thus, completing the transaction process has become easier. Their testimonials show an increase of 47% in revenue increase in their clients. Processing fees are bifurcated into four categories.

- In person: 2.6% + 10¢ per transaction

- Online: 2.9% + 30¢ per transaction

- Manually entered: 3.5% + 15¢ per transaction

- Invoices: 3.3% + 30¢ per transaction

Pros

- Easy to set up.

- Seamless omnichannel selling.

- Flexible POS system for scaling businesses.

- Simple pricing model.

Cons

- Frozen funds reported; account stability issues.

- Most high-risk businesses cannot use it.

- Users of Square POS only can use it.

9. Opayo

Opayo is a London based payment gateway in the UK owned by Elavon. It was founded in 2001 and as per official reports, it generates more than £41 million annually. Opayo accepts more than 30 foreign currencies with the complete security and encryption process.

With this payment gateway, customers can pay by link or the virtual terminal. Also, merchants can customize payment options for regular customers in Opayo’s interface. Merchants get access to See real-time business reports, card transactions, payment settlements and more, on their online portal.

Opayo’s is backed by Paprika, Icelandair, and Translink client’s trust. From 1.75% transaction fee to 0.99% transaction fee Opayo charges. However, it depends on which of their pricing plan you choose. Card readers and POS (Point of Sale) devices are also available which costs up to £62 per device monthly.

Pros

- Accepts payments in over 25 currencies

- Handles phone payments and eInvoices

- Has advanced fraud prevention and security features

- Offers a variety of payment options including cards, online payments, and mobile payments

Cons

- Costly add-ons can add up quickly

- Not suitable for complete beginners

- Not suitable for low-volume businesses

10. Mollie

Mollie is a Dutch payment gateway running operations in the UK since 2021. It was founded in 2004 and has 2,10,000+ business users using their financial services. 10+ products are available for merchants and buyers which gives them an extensive range of services.

Their products range from embedding the payment system to accepting online payments and fast funding for business capital. Credit/ Debit cards, Bank transfers, Digital wallets, PayPal, and BNPL (Buy Now Pay Later) are available on the platform.

Mollie charges about 2.5% plus 0.20 euros per transaction as their service fees. However, merchants processing transactions over €50,000 per month get a discount from the company’s side.

Pros

- Easy to set up and quick to use.

- Simple integrations with e-commerce platforms.

- 1 page checkout pages.

Cons

- No tech support outside of Europe.

- Cross-border e-commerce merchants face higher transaction fees.

- Instant deposits have additional costs.

FAQs

What is a payment gateway?

Payment gateways accept and transfer customer payment information. Payment gateways enable customers to pay for goods and services online. As well as being quick and secure, it also offers convenience and success when making payments.

How does a payment gateway work?

In both online and in-store purchases, payment gateways transmit financial data. The steps involved in the process are as follows: first, it accepts the shopper’s credit card number and other personal information. The second step is to verify the customer’s information and request payment authorization from the card issuer (the bank). After approval, the payment gateway transmits this information back to the retailer or merchant, allowing them to complete the purchase.

Are there free payment gateways?

Free payment gateways do not exist. Most cards charge a fee. Facilitators would charge you for these costs, which they would recover from you in the form of convenience fees.

After reading a detailed guide on the payment gateways in the UK, which one would you prefer? My wisdom says, there is no such perfect thing in the world! Some of them charge higher transaction fees while some payment gateway providers like Molle do not function outside the European region. Therefore, evaluate the capital and business size you are running.

Moreover, calculate the transaction amount which is processed daily or annually in your business. Then, choose the pricing plan and security features of the payment gateway in the UK. Lastly, check the PCI compliance also to prevent fraudulent activities. Thank you!