Forex trading apps are a scalding topic in the UK! Just like currency enthusiasts everywhere, the UK audience too is drawn to the idea of easy access to forex trading through their phones. After all, forex trading is the world’s largest financial market, with a daily volume surpassing $6 trillion. A user-friendly forex trading app is a valuable tool for anyone wanting to navigate this exciting and complex world.

Even though forex trading is becoming more popular in the UK, it is still highly regulated, and getting started as a forex trader isn’t always easy. In addition to the major difficulties, pairing with the best forex trading app approved by the Financial Conduct Authority (FCA) is also essential.

To make your efforts worthwhile, you should work with a broker who is licensed in your country and authorised by the FCA. Residents can only speculate in the currency market by using a foreign broker that takes UK clients because there are limits on locally authorised financial institutions in the UK. There are certain restrictions on different forex trading applications, as the competition is fierce in the overall forex VPS hosting environment.

To empower your UK forex trading journey, we’ve compiled a comprehensive guide to the best forex trading platforms and apps of 2025 suitable to meet the demands of traders in the UK. This in-depth analysis compares features, performance, fees, customer support, and reputation, helping you select the perfect Forex app for your trading goals. So let’s wait no more and begin with our detailed guide.

What Are Forex Trading Apps? Differentiating Between Apps And Softwares

We all know that applications are made from the perspective of smartphones. Thus, there’s no rocket science in understanding what forex trading applications are. Forex trading apps are mobile applications designed specifically for smooth operations in the forex market. With the help of these apps, you can easily buy or sell currencies on the foreign exchange market.

On the other hand, forex trading software is made for desktops, laptops, and PCs. These best forex trading softwares offer advanced features like charting tools, backtesting, and automated trading strategies, which are difficult to steer down in the mobile view.

The major difference we can spot is that forex trading applications are built for convenience and a user-friendly way to trade, allowing traders to monitor markets, place orders, and much more simply by using their accounts from their smartphones or tablets. Also, forex trading software needs efficient hosting solutions, like dedicated server or cloud server.

Table of Content

Forex trading in the UK requires strict adherence to laws and is primarily regulated by the Financial Conduct Authority (FCA). The FCA is an approved regulatory organisation known for its strict approach to licensing. Traders can have a successful trading career if they operate with an FCA-regulated broker adhering to the transparency and integrity of financial firms.

A reliable forex trading app approved by the FCA with a top-notch hosting service provider adds a streamlined exchange of currencies. Here’s the list of the top forex trading apps of 2025 for the UK forex market.

AvaTrade

AvaTrade has been a popular and globally regulated broker since 2006. It’s a popular choice among traders looking for a user-friendly and the best forex trading platform. It comes with a wide range of functions, including in-platform exchange indicators, advanced charts, and access to over 1,000 devices, which include currencies, shares, and commodities.

Developed by: Ava Trade EU Ltd.

Commissions and Fees: Commissions vary depending on the currency pair and account type. Expect a range starting at 0.9 pip (percentage in points) for major forex pairs.

Cons: AvaTrade has very limited educational resources compared to other competitors. It is not sufficient to handle the high-volume traders due to the fee structure.

IG

While looking for the top forex trading applications in the UK, IG comes as a holistic forex trading solution. Apart from its global recognition, it offers the best real-time news feeds and an educational resource hub.

Developed by: IG Group

Commissions and Fees: Variable spreads based on the market and account type. CFDs incur financing charges.

Cons: While IG is a globally operating broker, it offers very limited customer support for localised audiences. It has higher fees compared to some other UK forex brokers.

If you are looking for the best ways to become a forex broker, refer to your detailed blog on How to Become a Forex Broker: A Step-by-Step Guide

OctaFX

Mobile forex trading app OctaFX is available for users worldwide, including those in the UK. With it, you can access features like real-time quotes, charting tools, and copy trading. In addition to the features, this forex trading app in the UK offers a low minimum deposit tool that leverages budget issues.

Developed by: Octa Markets Incorporated

Commissions and Fees: The rates of commissions vary by market and account type and inactivity fees are charged for dormant accounts.

Cons: Customer support is not readily available as compared to others.

Interactive Brokers

Interactive Brokers Trader Workstation (TWS) is a mobile forex trading app. It has the easiest access to the market, where users can trade in forex, F&O, and others. For UK-based traders, Interactive Brokers provides advanced order types, powerful charting tools, and global market research, making it easy for traders to access trading tools and have a keen interest in extensive market research.

Developed by: Interactive Brokers LLC.

Commissions and Fees: Competitive commission structure with a minimum commission of USD 10 per trade. Inactivity on the account leads to charges.

Cons: While Interactive Brokers is a globally active forex trading platform, it has a complex interface.

IronFX

If you are looking for the best forex trading platform for mobile and desktop, then IronFX offers a comprehensive solution for the same. Whether you want to trade currencies, commodities, indices, and other CFDs (Contracts for Difference), IronFx has it all. Since then, it has been among the top forex trading apps in the UK. Furthermore, its authorization and regulation under the FCA make it the most secure and trusted forex trading app among its users.

Developed by: IronFX

Commissions and Fees: There is a specific commission and fee structure for spreads, swaps, and account maintenance.

Cons: Unlike other unregulated brokers, it has restricted trading flexibility.

Tickmill

The UK audience prefers the best forex brokers that can be user-friendly mobile apps to trade currencies, indices, and other CFDs. Tickmill is not only an easy-to-use forex trading application but also offers seamless integrations with the popular MT4 and MT5 (MetaTrader 4 and MetaTrader 5) platforms, along with its own mobile app for on-the-go trading.

Developed by: Tickmill Group

Commissions and Fees: Similar to IronFX, Tickmill also has a commission structure for spreads, swaps (overnight financing fees), and additional platform fees.

Cons: Tickmill’s in-app has limited research tools and less extensive educational resources.

CFA vs. Globally Operating Forex Trading Apps: Which Apps Should You Choose?

When choosing the best forex trading application for the UK and the United Kingdom’s trading markets, make sure your safety is of the utmost importance. The most recommended way is to choose the CFA-authorised forex trading app for UK trades, as such apps operate under the regulations of the government.

This is the safest and most secure way to protect investors, traders, and beginners alike. Even when you face any issues related to your forex trade, you can have access to CFA’s grievance redressal mechanisms for dispute resolution.

This is not the same in the case of globally operating forex trading platforms. Globally operating apps have limited customer support options for specific localised users, which is not suitable for beginners. However, globally recognised apps offer a wider range of features and functionalities compared to CFA-authorised apps.

The best alternative is to go for a balanced approach, that is, to review the top forex trading platforms that adhere to CFA regulations for forex trading in the UK. For instance, the IG forex trading app is both CFA-authorised as well as a globally operating forex trading platform.

In our blog, we have included both CFA-authorised forex trading applications as well as globally operating forex trading platforms.

FCA Authorised

- IG

- Tickmill

Globally Operating Forex Trading Apps

- AvaTrade

- OctaFX

- Interactive Brokers

- IronFX

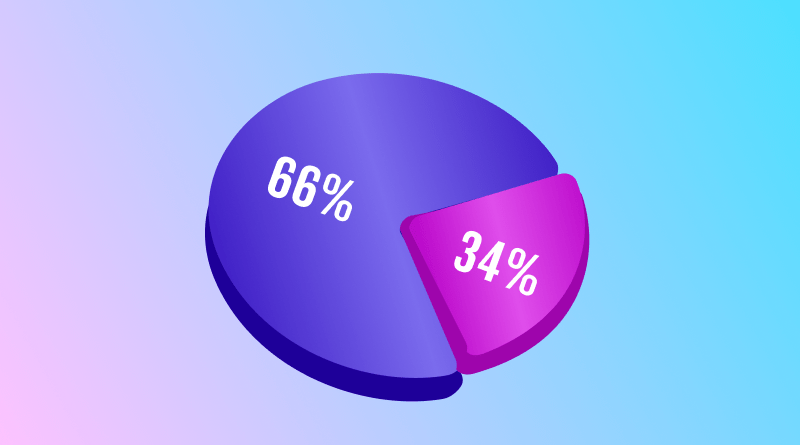

An estimated report of the UK forex trading apps market states that there are around ~66% CFA-authorised forex trading app users, while ~34% of users go with globally operating forex trading apps.

IThe UK forex market is vast and caters to different individual needs. It consists of different trading apps that act as brokers. Through deep research, you can easily find forex trading apps approved by FCA licensing and regulations, forex trading apps for beginners, and some free forex trading apps for the UK.

Whether you’re a novice or a skilled trader, advanced trading functions, the best support, and low commission rates are all that you want. Remember, prioritising CFA-authorised apps is important for protection and regulatory compliance, while globally operated platforms help you trade beyond the UK market.

Carefully analyse the capabilities, costs, and support offered via each app, and then make your ultimate decision. So, dive into the blog, get the compared data, and test with top forex trading applications for the UK. The world of foreign exchange trade is waiting for you!

FAQs:

What are forex trading apps?

Forex trading apps are mobile applications. Consider them similar to the other apps that you use on your smartphone. These apps are built for trading purposes and allow traders to buy and sell currencies on the foreign exchange market.

What apps do I need for forex trading?

The only essential app you truly need is a forex trading app offered by a reputable, CFA-authorised broker in the UK. While looking online, you’ll find several forex trading apps and brokers, but not all of them are forex trading apps approved by the CFA. Check out the blog to find out the best apps for forex trading in 2025.

What features should I look for in a forex trading app?

There are several important features to consider when choosing the top forex trading app for the UK trading sector, including a user-friendly interface, real-time market data, charting tools for technical analysis, and secure options for placing orders. Additionally, some apps have educational resources and social trading for an enhanced trading experience.

Can I trade all currency pairs on a forex trading app?

While foreign exchange is carried out in almost all currency pairs, there are some limitations set by the app itself. Most of the above-mentioned apps offer all popular currency pairs, but it’s advisable to check with the forex trading application for a complete list.

Is mobile trading as reliable as desktop trading?

Yes. Due to modern technology, the recently upgraded forex trading apps are reliable and offer most of the functionalities available on desktop platforms. However, to view some advanced trading charts, traders prefer the larger screen size by opting for desktop trading.